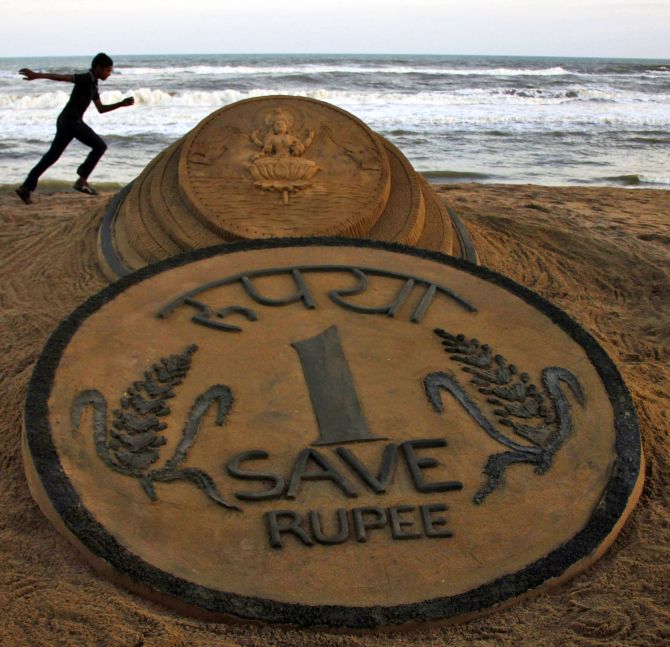

Mumbai, Sept 4:

The rupee further slipped 193 paise to 67.95 against the dollar on

persistent capital outflows and heavy dollar demand from banks and oil

importers at 4.26 p.m. local time.

The domestic unit opened 28 paise weaker to 66.30 per dollar against the

previous close of 66.02 due to renewed dollar demand from importers and

appreciation of the American dollar overseas.

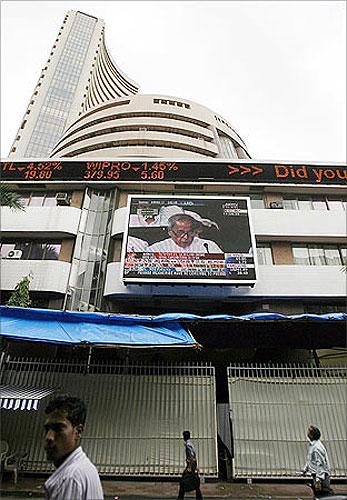

Meanwhile, the 30-share BSE index Sensex ended down 651.47 points (3.45 per cent) at 18,234.66.

According to forex dealers, besides dollar’s gains against the yen and

euro on improved economic data, increased demand from importers for the

American currency also put pressure on the rupee.

Brinda Jagirdar, Economist, said: "While the sharp fall in rupee and its

aftermath has caused a lot of mayhem on the markets, particularly

pressure on corporates and banks, its impact on exports could be

positive. However, the recent PMI data coming in at below 50 (at 48.5)

has highlighted the contraction in the manufacturing sector. Thus, at a

time when external demand appears to be rising on the back of economic

recovery - Germany's PMI is the highest since July 2011 - India's PMI is

at a four-year low, so the economy is unable to ramp up its

manufactured exports and benefit from a weak rupee.''

The rupee sentiment was hit on lower GDP growth data announced last week.

India’s GDP (gross domestic product) growth decelerated to 4.4 per cent —

the slowest pace of expansion since the 2008 meltdown — in the first

quarter (April-June) of the current fiscal.

Special dollar window

Further, the Reserve Bank of India had announced a special dollar window

for oil retailers, which helped ease the offshore non-deliverable

forward (NDF) contracts.

“The RBI measures limited the volumes in the currency market by more

than half. Hence, the volatility reduced to some extent. Also, the RBI

did not intervened for the first time in many days,” said a dealer with a

nationalised bank.

The rupee saw sharp movements last week. It had hit a historic low of

68.80 against the US dollar on August 28. It had dropped 3.7 per cent

during last week alone.

Rupee depreciation

The Ministry of Finance had said that the rupee depreciation is not

reflective of any weakness in the economy. Also the rupee is heavily

under-valued at the moment and it is being addressed.

Though a strong dollar and dollar demand from importers limited the

rupee gains, investors are hoping for positive measures after the new

RBI Governor assumes charge on September 5.

Call rates, G-Secs

The inter-bank call money rate, the rate at which banks borrow money

from each other to meet their short-term fund requirements, was trading

lower at 10.15 per cent from its previous close of 10.25 per cent.

The 7.16 per cent government security, which matures in 2023, was

trading a tad higher at Rs 91.79 from the previous close of Rs 91.47

.Yields softened to 8.41 per cent from 8.47 per cent.

But

he said that a weaker currency was the natural outcome of several years

of high inflation, and although the rupee had overshot in the foreign

exchange market its decline would bring some economic benefits.

But

he said that a weaker currency was the natural outcome of several years

of high inflation, and although the rupee had overshot in the foreign

exchange market its decline would bring some economic benefits.

M

M