Ahost of positive factors such as sustained gains in the rupee and easing tensions over Syria kept the stock markets upbeat for the fourth session today with the benchmark BSE Sensex zooming 727 points, the most in more than four years.

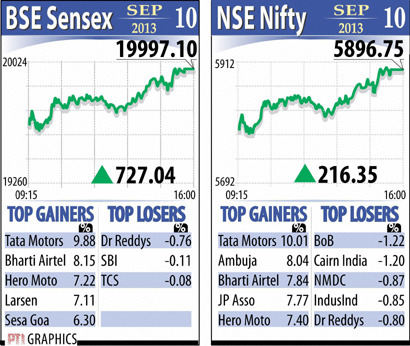

All sectoral indices gained, led by auto, capital goods and FMCG stocks. The top Sensex winners were Tata Motors, Bharti Airtel, Hero MotoCorp and Larsen & Toubro.

Apart from the rupee's gains, investors were buoyed by trade data that showed exports on the uptick for the second straight month in August, a revival in car sales last month and a cut in the floor price for auctioning telecom spectrum.

The 30-share Sensex resumed on a strong note as Asian stocks rose, triggered by a rally on Wall Street yesterday. The index breached the 20,000 mark for the first time since July 25, before settling at 19,997.10, higher by 727.04 points or 3.77 per cent.

It was the biggest gain in absolute terms since the Sensex surged 2,110.79 points, or 17.34 per cent, on May 18, 2009, when the UPA government came to power.

The NSE Nifty index jumped 216.35 points, or 3.81 per cent, to 5,896.75, after touching 5,904.85. MCX-SX's SX40 index ended at 11,849.66, up 458.1 points or 4.02 per cent.

The rupee continued its upward journey for the fourth consecutive day and traded at a two-week high of 64.25 against the dollar in afternoon deals, up 99 paise.

The threat of immediate US-led military action against Syria appeared uncertain, with Washington saying it will consider Russia's call for Syria to turn over its chemical weapons to international control.

"Markets up-move continued today due to favourable trade data," said Rakesh Tarway, AVP of research at Motilal Oswal Securities Ltd. "Moreover, indications of reduced tension in Syria also helped the markets today."

FII buying was also driven after the RBI allowed non-residents to buy shares of Indian entities listed on stock exchanges under the FDI