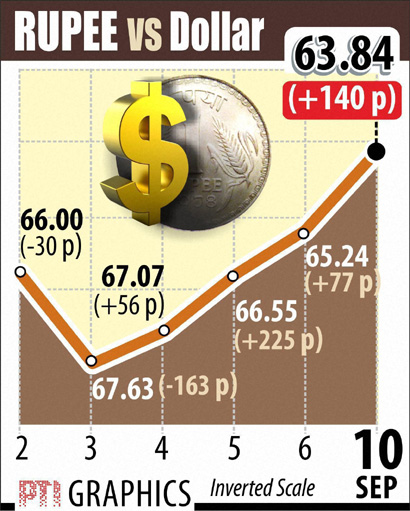

The Indian rupee on Tuesday closed above the 64 mark at 63.84 against the dollar, up 140 paise -- the biggest in two weeks -- as fears of a US military strike on Syria eased amid lower global oil prices.

Banks and exporters preferred to reduce their dollar positions on expectations of additional foreign fund flows into the equity market.

The rupee resumed higher at 64.40 a dollar from Friday's close of 65.24 and touched a low of 64.54 at the interbank foreign exchange market. It later bounced back to breach the 64 mark and touch a high of 63.78 before settling at 63.84, a rise of 140 paise or 2.15 per cent.

Today's rise was the biggest since it added 225 paise on August 29. In four straight sessions, the local currency has flared up by 379 paise or 5.6 per cent.

US jobs data on Friday fell short of expectations, leading to speculation that the tapering of the US Federal Reserve's bond-buying programme would be delayed.

India's exports rose for the second straight month in August, while the trade deficit narrowed as gold imports fell, the Commerce Ministry said today.

"The downbeat jobs data from the US led to losses in the US dollar index, thereby helping the rupee and other Asian currencies to post gains," said Abhishek Goenka, CEO of India Forex Advisors. "Also, today's trade deficit data...was seen supporting the rupee as it showed the trade gap reduced to USD 10.9 billion in August from USD 12.27 billion in July."

The benchmark S&P BSE Sensex surged 727 points today, the biggest gain in absolute terms in more than four years.

Foreign institutional investors bought a net Rs 2,563.60 crore of shares today and Rs 800.71 crore of shares on Friday, as per provisional data from the stock exchanges.

Brent (oil) crude futures fell below USD 113 a barrel as supply fears eased on Syria developments.

"The trading range for the spot USD-INR pair is expected to be within 63 to 65," said Pramit Brahmbhatt, CEO of Alpari Financial Services (India). "The government is also set